It includes the understanding that there is a remote likelihood that material misstatements will not be prevented or detected on a timely basis. The providing of various accounting or data-processing services by an accountant, the output of which is in the form of financial statements ostensibly to be used solely for internal management purposes. You will learn the fundamentals of financial accounting from the ground up and apply your understanding of financial statements in a wide range of business settings. To gauge a company’s financial health—whether it’s your own, your employer, or a potential investment—there’s no better place to start than its financial statements. These documents contain a wealth of information that can inform everything from budgeting and product development to business strategy and decision-making. The statement of stockholders’ (or shareholders’) equity lists the changes in stockholders’ equity for the same period as the income statement and the cash flow statement.

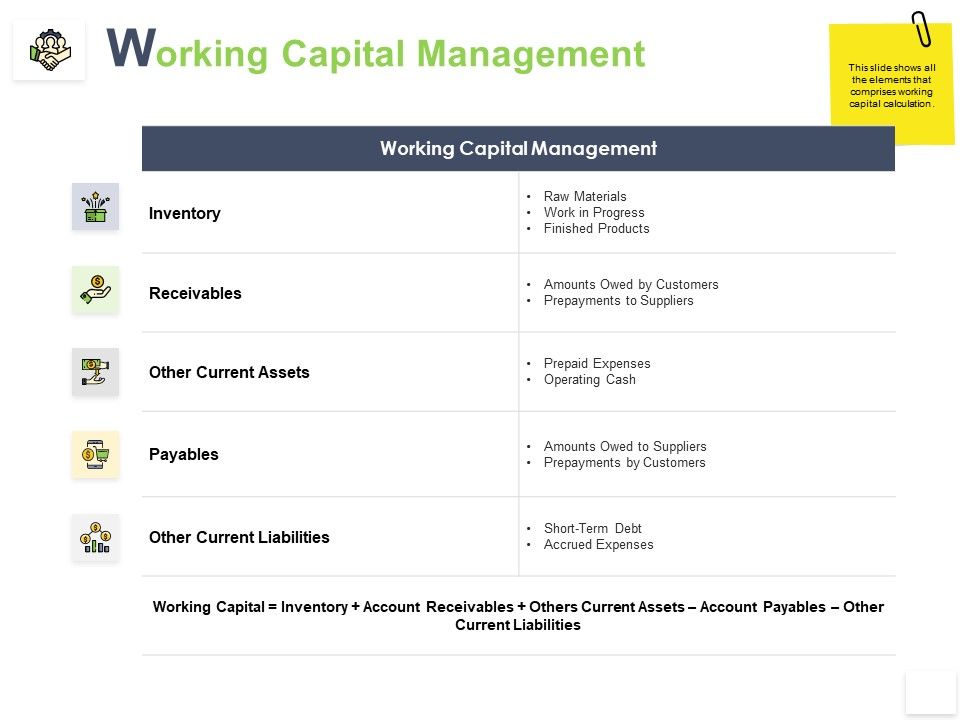

Amount, net or CONTRA ACCOUNT balances, that an ASSET or LIABILITY shows on the BALANCE SHEET of a company. Funds used by a not-for-profit organization to account for all resources used for the development of a land improvement or building addition or renovation. Financial plan that serves as an estimate of future cost, REVENUES or both.

The process of recording financial transactions and keeping financial records. Legal process, governed by federal statute, whereby the DEBTS of an insolvent person are liquidated after being satisfied to the greatest extent possible by the DEBTOR’S ASSETS. During bankruptcy, the debtor’s assets are held and managed by a court appointed TRUSTEE. A way of arriving at the cost of inventory that computes the average cost of all goods available for sale during a fixed period in order to determine the value of inventory. A ratio that shows the average length of time it takes a company to receive payment for credit sales. The average number of days required to sell the current inventory of products available for sale.

Trial Balance

BOND on which the holder receives only one payment at maturity which includes both PRINCIPAL and INTERESTfrom issuance to maturity. Graph showing the TERM structure of interest rates by plotting the yields of all bonds of the same quality with maturities ranging from the shortest to the longest available. (1) Records kept by the AUDITOR of the procedures applied, the tests performed, the information obtained, and the pertinent conclusions reached in the course of the AUDIT. (2) Any records developed by a CERTIFIED PUBLIC ACCOUNTANT (CPA) during an audit.

- BOND INTEREST payment covering less than the conventional six-month period.

- Given the importance of financial accounting, the Financial Accounting Standards Board (FASB) sets regulations for financial accounting, referred to as GAAP (the generally accepted accounting principles).

- Material event that occurs after the end of the accounting period and before the publication of an entity’sFINANCIAL STATEMENTS.

- A temporary ACCOUNT used under the PERIODIC INVENTORY SYSTEM to record the TOTAL COST of all MERCHANDISE purchased for resale during an accounting period.

These reports, including the most recent, are available in our Reference Library by quarter. Start learning today and accelerate your business and finance acumen. ZERO-COUPON BOND convertible into the COMMON STOCKof the issuing COMPANY when the stock reaches a predetermined price. Each taxpayer is allowed to claim a withholding allowance, which exempts a certain amount of wages from being subject to WITHHOLDING. The allowance is designed to prevent too much taxes being withheld from a taxpayers wages and a person can compute this by completing form W-4 and submitting it to their employer.

What Financial Accounting course content changed with the 2021 updates?

Organization engaged in business as a PROPRIETORSHIP, PARTNERSHIP, CORPORATION, or other form of enterprise. Mixing ASSETS, e.g. customer-owned SECURITIES, with those owned by a firm in its proprietary accounts. A way of measuring the ability of sales to generate operating CASH FLOWS. Short-term (generally less than three months), highly liquid INVESTMENTS that are convertible to known amounts of cash. Method of bookkeeping by which REVENUES and EXPENDITURES are recorded when they are received and paid.

You may also hear the income statement referred to as the profit and loss statement. Price charged by individual entities in a multi-entity COPORATION on transactions among themselves; also termed transfer cost. Any individual or other taxable entity that is required to file a return, statement or any other document with the IRSmust indicate his (or its) taxpayer identification number. For an individual, the social security number is used, and if you do not have a social security number, the IRS will assign you a TIN. A federal or employer ID number is assigned to other types of entities and will use that as their TIN.

Equity Method of Accounting

The amounts can be found on the individual forms as the limitations and computation may change each tax year. A taxpayer, whether business or individual, must file a request on a form. It must also be filed within the timeframe allotted or the refund may be lost. An individual can claim a refund back to whatever year it was due but it will only be paid three years back or less. ASSET account on a balance sheet representing paper currency and coins, negotiable money orders and checks, bank balances, and certain short-term government securities. Provision of tax law that allows current losses or certain tax credits to be utilized in the tax returns of future periods..

Duo World : Change in Certifying Accountants – Form 8-K – Marketscreener.com

Duo World : Change in Certifying Accountants – Form 8-K.

Posted: Mon, 21 Aug 2023 12:48:05 GMT [source]

In the example above, the consulting firm would have recorded $1,000 of consulting revenue when it received the payment. Even though it won’t actually perform the work until the next month, the cash method calls for revenue to be recognized when cash is received. When the company does the work in the following month, no journal entry is recorded, because the transaction will have been recorded in full the prior month. Which accounting principles are used depends on the regulatory and reporting requirements of the business. A balance sheet shows what a company owns (its assets) and owes (its liabilities) on a particular date, along with its owner’s equity or shareholders’ equity. Financial accounting is concerned specifically with the generation of these reports, that they are based on accurate information and follow Generally Accepted Accounting Principles (otherwise known as GAAP).

Effective Tax Rate

A multicolumn journal used to record sums of cash paid out for expenses. Net of cash receipts and cash disbursements relating to a particular activity during a specified accounting period. INTEREST cost incurred during the time necessary to bring an ASSET to the condition and location for its intended use and included as part of the HISTORICAL COST of acquiring the asset. Outlay of money to acquire or improve capital assets such as buildings and machinery.

Stock rights are rights issued to stockholders of a CORPORATION that entitle them to purchase new shares of stock in the corporation for a stated price that is often substantially less than the FAIR MARKET VALUE of the stock. These rights may be exercised by paying the stated price, may be sold, or may be allowed to expire or lapse. A formal STATEMENT summarizing the flow of all manufacturing costs incurred during an accounting period.

The changes will include items such as net income, other comprehensive income, dividends, the repurchase of common stock, and the exercise of stock options. Outside the U.S., many countries require that public companies follow a parallel set of accounting standards called International Financial Reporting Standards (IFRS). While IFRS has some differences from GAAP, U.S. law allows foreign companies with U.S. operations to use IFRS for their financial reporting. Financial accounting primarily focuses on preparing and reporting financial statements, but businesses also rely on other forms of accounting.

The process of determining the PRESENT VALUE of a BOND based on the current MARKET INTEREST RATE. To assume the RISK of buying a new ISSUE of securities from the issuing CORPORATION or government entity and reselling them to the public, Financial accounting either directly or through dealers. MUNICIPAL BOND term referring to the debt of government entities within the jurisdiction of larger government entities and for which the larger entity has partial CREDIT responsibility.

This information can be used to prepare financial statements such as income and balance sheets. Financial Accounting Standards were developed to unify and standardize how companies manage their accounting. These are various rules governing how to record the balances of a company’s accounts. It ensures that the financial statements accurately reflect the business’s economic situation. Generally Accepted Accounting Principles (GAAP) and International Accounting Standards (IAS) are common accounting standards.

The expenses are registered when incurred and revenues are registered once they are earned, not when they are paid. Usually, large businesses and public companies tend to apply the accrual method because it presents a more realistic financial picture during a given period. On the flip side, it doesn’t depict the actual cash flow and can have terrible consequences if you are not keen. The main factor that creates a distinction between the accrual method and the cash method of accounting is timing. The cash basis is immediate in that it only registers expenses and revenues once money has exchanged hands.

Reporting to stockholders and the public, as opposed to internal reporting for management’s benefit. Each governing agency and its forms scheduled reporting and most importantly payments have a required due date. It is this date that if most files timely may result in a penalty, fine, and commence interest charges. These have the objective of detecting errors or fraud that have already occurred that could result in a misstatement of the financial statements. Qualified child care expenses will allow a taxpayer this computed credit against tax.

An AUDITOR that has a reasonable understanding of audit activities and has studied the company’s industry as well as the accounting and auditing issues relevant to the industry. The difference in perception between the public and the CPA as a result of accounting and audit service. Transfer of money, property or services in exchange for any combination of these items. Activities that involve management judgments or assumptions in formulating account balances in the absence of a precise means of measurement. Amount of tax LIABILITY a taxpayer may expect to pay for the current tax period.